I’m sure you already know the market had a crazy week. Maybe it’s tech (and frothy valuations). Maybe it’s interest rates. Maybe it’s ARK Invest?

Who knows.

What I know is that there are a lot of tech / tech-like things going up like rockets 🚀🚀🚀 that do not and are very unlikely to eventually have tech-like economics (e.g. EVs). If I’m proven wrong, great! EVs are ultimately good for the world. But it doesn’t necessarily mean it will be good for investors at any price. And the great thing about investing is that it’s not Pokemon – You don’t have to catch them all.

And there are also a lot of real tech companies with potential for fantastic economics that are going up like rockets 🚀🚀🚀. With a long enough time horizon, they could all be very cheap. It’s not crazy to bet on those excellent businesses that we have diligently assessed to have great or likely potential for great economics…but it still wouldn’t make much sense to bet everything on an uncertain future, especially if we are talking really, really far in the future.

As always, it makes sense to diversify and pick the right spots.

If Capital Flywheels (and the Paper Portfolio) weren’t invested early in a lot of high-flying names, it would be a lot harder to justify establishing positions…though the rapid sell-off in this past week certainly makes things a LOT more interesting.

But leaving aside what is going on with the markets, at the end of the day, what bails out high valuations is and will necessarily always be the future. If the future is good, a high valuation will be bailed out in time. The higher the valuation, the more amazing the future needs to be.

This is not just a matter of hope. Eventually the market runs out of hope, and companies (and the future) need to deliver the goods. Investing in tech and the cutting edge of innovation is always a tricky balance because of this. These are areas where the least informed people tend to have the highest hope. And any investor trying to out-compete the least informed person for stock in a high-flying company better have good reasons for doing so.

With that said, Capital Flywheels has also observed many situations where, despite high hopes, the market is not hopeful enough. Apple is a great example of this. Apple is a company that is followed by thousands of professional analysts and tens of millions of investors. All with very high hopes. But despite their highest hopes, for over a decade Capital Flywheels has been certain that their hopes were NOT high enough.

That’s the situation I think most of the market is in today. A lot of things are very expensive. The worst mistake is to buy something the future is unlikely to bail out. It’s not necessarily a mistake to buy something that everyone is hopeful about assuming the company will deliver in the future, but unless those high expectations are exceeded somehow, the results are also unlikely to be spectacular. But finding the rare gems that can exceed even high expectations is what will separate average from spectacular.

None of this is easy, but you don’t need to find 100 or even 10 of them. All you need are just 1 or 2 every few years. And just finding 1 or 2 of those can give you the luxury of sitting and doing nothing when other investors are losing their minds.

In any case, below’s what I found interesting this week. Which of these whisper the potential to exceed even high expectations?

🗺 Geopolitics

#1 Biden Putting Tech, Not Troops, at Core of U.S.-China Policy

The Biden administration is moving to put semiconductors, artificial intelligence and next-generation networks at the heart of U.S. strategy toward Asia, attempting to rally what officials are calling “techno-democracies” to stand up to China and other “techno-autocracies.”

The new framing for the U.S. rivalry with China has been given added urgency by the sudden global shortage of microchips needed in products such as cars, mobile phones and refrigerators. The strategy would seek to rally an alliance of nations fighting for an edge in semiconductor fabrication and quantum computing, upending traditional arenas of competition such as missile stockpiles and troop numbers.

…

“There’s a newfound realization about the importance that semiconductors are playing in this geopolitical struggle because chips underlie every tech in the modern era,” said Lindsay Gorman, a fellow for emerging technologies at the German Marshall Fund of the U.S. “It’s an effort to double down on the technological comparative advantage that the U.S. and its democratic partners.”

Source: Bloomberg

The trade war was always a ruse since trade is mutually beneficial to both US and China, even if it may not seem that way to many Americans.

But the tech war is not going away. We are at the foothills of a prolonged fight in technology.

Cooperation requires mutual trust. And there is no mutual trust. The Chinese cannot fundamentally trust being a technological laggard to the US because US policies are ever changing. If China is planning for the next 100 years, it is easier to assume that the US relationship will be unreliable than to assume that it will be reliable. Therefore, China’s logical stance is to not trust the US.

The same can be said from the US perspective. The US might want to trust China, but two decades of trust has resulted in very little to show. And if you know the other party (China) already cannot and does not want to trust you, it makes little sense to grant unilateral trust. Therefore the US’ logical stance is to also assume the relationship will not be reliable.

We are in a prisoner’s dilemma. The best outcome is for both sides to trust each other. But the dominant strategy on both sides is to not trust.

Near-term, the area that will continue to see the most tension is on semiconductors and chip manufacturing:

#2 China Revs Up Grand Chip Ambitions to Counter U.S. Blacklistings

In just two decades, China sent people into space, built its own aircraft carrier and developed a stealth fighter jet. Now the world’s youngest superpower is setting out to prove its capabilities once more — this time in semiconductors.

At stake is nothing less than the future of the world’s No. 2 economy. Beijing’s blueprint for chip supremacy is enshrined in a five-year economic vision to be unveiled during a summit of top leaders in the capital this week. It’s a multi-layered strategy both pragmatic and ambitious in scope, embracing aspirations to replace pivotal U.S. suppliers and fend off Washington, while molding homegrown champions in emergent technologies.

China wants to build a coterie of technology giants that can stand shoulder-to-shoulder with Intel Corp. and Taiwan Semiconductor Manufacturing Co., conferring the same priority on that effort as it accorded to building atomiccapability. While specifics of that endeavor won’t emerge for months, comments by government officials, Party mouthpieces like the People’s Daily and state think-tanks provide important clues about the envisioned road map.

Source: Bloomberg

What China has achieved in three decades is truly impressive. But in many ways, a lot of what China has done in most industries is catch up in terms of knowledge and process. Chipmaking is a fundamentally different thing because chipmaking is still an evolving space. Chipmaking is not mature. And chipmakers are at the leading edge of innovation and manufacturing. To excel in chipmaking requires not only catching up to existing knowledge and process (which in itself will already require immense effort), but to invent new technologies.

For example, the leading technology in chipmaking right now is ASML’s EUV (extreme ultraviolet) technology…while it seems “new”, ASML has been working on this technology for almost two decades and only started to commercialize it a few years ago. “New innovation” often takes decades of work. China has a tall order to achieve “innovation”, though I think China will continue to surprise and impress with their ability to catch up in areas that seem very difficult to catch up in.

Meanwhile, it’s at least a bit ironic that the US, whom used to be the leader in semiconductor manufacturing, has become highly dependent on Taiwan / TSMC (and to a lesser extent, Korea / Samsung) for manufacturing at the leading edge. China lags, but the US is dependent on Taiwan (which China official claims as its territory) for actual manufacturing.

This is somewhat of an untenable / unstable situation long-term, hence both TSMC and Samsung have been incentivized to build manufacturing capacity in the US.

#3 China charges ahead with a national digital currency

China has charged ahead with a bold effort to remake the way that government-backed money works, rolling out its own digital currency with different qualities than cash or digital deposits. The country’s central bank, which began testing eCNY last year in four cities, recently expanded those trials to bigger cities such as Beijing and Shanghai, according to government presentations.

…

But while Bitcoin was designed to be decentralized so that no company or government could control it, digital currencies created by central banks give governments more of a financial grip. These currencies can enable direct handouts of money that expire if not used by a particular date and can make it easier for governments to track financial transactions to stamp out tax evasion and crack down on dissidents.

Over the last 12 months, more than 60 countries have experimented with national digital currencies, up from just over 40 a year earlier, according to the Bank for International Settlements. The countries include Sweden, which is conducting real-world trials of a digital krona, and the Bahamas, which has made a digital currency, the Sand Dollar, available to all citizens.

In contrast, the United States has moved slowly and done just basic research. At a New York Times event last week, Treasury Secretary Janet Yellen indicated that might change when she said a U.S. digital currency was “absolutely worth looking at” because it “could result in faster, safer and cheaper payments.”

Source: Seattle Times / Bloomberg

The other arena that will continue to see tensions is the financial realm. In the past decade, the US has increasingly shown its willingness to wield its currency and financial system as a weapon. For China, a country that already rationally distrusts the US, it needs a way to ween itself off the US financial system.

This is very difficult to do because modern currencies, especially the US Dollar, is as much a network as it is a currency.

However, as Capital Flywheels wrote in “In Dollar We Trust (And Why China Would Prefer Otherwise)“, the power of the USD network stems from how the custody of currency works. It’s quite onerous to have everyone move physical currency around, especially in our fast modern society. Most commercial transactions only involve digital movement of currency. However, we trust that this works only because we know the physical money is being held in a centralized location by a neutral 3rd party (custodian) that can vouch that the money is there. For example, your bank. So if someone sends me “$1 million” digitally, I can feel safe and assume it exists because the other party’s money is held at a bank that can vouch for its existence. And for banks and countries, the centralized location is the Fed. The power of this system rests on the efficiency of centralized custody.

So if you were China (or another nation that wants to break the grip of the USD), what can you do? You will very likely spend most of your time innovating on ways to break the need for custody. The need for custody in our current world is because there is a mismatch between the hyper-commercialized world we live in and the slow process of sending physical money. So we’ve decided to not send physical money at all. We send digital dollars, but the physical money still needs to be stored at a centralized location that has good reputation and can vouch for the money’s existence.

But if TRUE digital currencies take off like the digital yuan, then there would be no custody problem at all. You can send the ACTUAL currency around without any inefficiencies at the same speed as any modern commercial transaction. This would dramatically weaken the network advantages of the USD. However, China would have to ramp up adoption of the digital yuan internationally before the US launches its own version. If the US launches a digital currency while still retaining its position as the world’s reserve currency, the USD will likely become the most dominant currency in history by far. The powerful overlapping network effects of the US financial network, US currency acceptance network, and US currency custody network will make the USD extremely difficult to dethrone.

🤑 Economics

#4 NFTs, explained

Excellent (and very easy-to-read) discussion about NFTs:

There’s nothing like an explosion of blockchain news to leave you thinking, “Um… what’s going on here?” That’s the feeling I’ve experienced while reading about Grimes getting millions of dollars for NFTs or about Nyan Cat being sold as one. And by the time we all thought we sort of knew what the deal was, the founder of Twitter put an autographed tweet up for sale as an NFT.

You might be wondering: what is an NFT, anyhow?

After literal hours of reading, I think I know. I also think I’m going to cry.

Source: The Verge

Are NFTs crazy? Maybe.

But Capital Flywheels will reiterate that cryptocurrencies actually make more sense as a way to “own” digital assets (e.g. NFTs) than to try to use cryptocurrencies as a currency.

Not least because the behavior of this function already more closely resembles what the average cryptocurrency user wants to do with their cryptocurrencies – HODLing it as a store of value. So if you’re going to HODL a token for $50k, why not HODL a special token that gives you unique ownership rights over a specific piece of art for $50k? You’re still HODLing something for $50k. At least with NFTs you get to own something unique.

#5 Kings of Leon Will Be the First Band to Release an Album as an NFT

On Friday, Kings of Leon will release their new album, titled When You See Yourself, in the form of a non-fungible token (NFT) — becoming the first band to ever do so.

The band is actually dropping three types of tokens as part of a series called “NFT Yourself,” people involved in the project tells Rolling Stone. One type is a special album package, while a second type offers live show perks like front-row seats for life, and a third type is just for exclusive audiovisual art. All three types of tokens offer art designed by the band’s longtime creative partner Night After Night; the smart contracts and intelligence within the tokens were developed by YellowHeart, a company that wants to use blockchain technology to bring value back to music and better direct-to-fan relationships.

Source: RollingStone

It’s interesting what two decades can do. Two decades ago, “rebel” youngsters were all about ripping music (or art) and not paying for it.

Now, two decades later, there is a growing desire to own “originals” even though digital technology makes it effortless to duplicate anything we want.

What does it mean / what will this mean for the economy?

One more:

#6 Grimes made $5.8 million in under 20 minutes selling crypto-based artwork

Grimes auctioned off a collection of digital artwork for millions of dollars.

The singer launched her digital collection, “WarNymph,” on Sunday and plans to sell the crypto art for 48 hours.

…

Grimes’ 10 NFTs brought in over $5.8 million in under 20 minutes. The singer had announced the auction on Twitter.

Source: Business Insider

Source: Twitter

And…when will we start talking about this as “money printing”? All the NFTs, SPACs, and IPOs seem quite a bit like money printing to me…

Capital Flywheels continues to believe that a lot of money printing isn’t happening at the Fed, it’s happening by and through the People.

🎭 Society

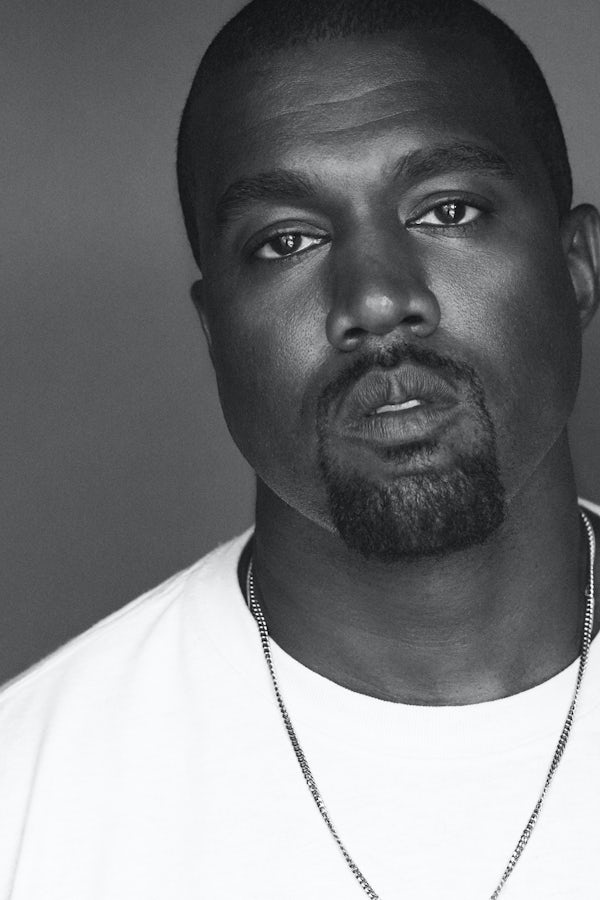

#7 Kanye West Is ‘Focused’ on Apparel Line Launch, Gap CEO Says

Kanye West remains focused on developing his apparel line for Gap Inc., according to the chief executive officer Sonia Syngal.

“I spoke to Yeezy last night and he’s very, very focused on this incredible opportunity,” Syngal said Thursday in a call with analysts.

West will launch his apparel line with the San Francisco-based retailer toward the latter part of the first half of the year, Gap executives said.

Gap and West announced the partnership, which will be called Yeezy Gap, in 2020 and have been at work designing products in Wyoming, where West has a ranch. The deal is for 10 years and includes apparel for men, women and kids. It does not include footwear, since the Yeezy brand is in a long-term deal with Adidas.

Source: Business of Fashion / Bloomberg

Did not know that Kanye has a partnership with Gap…would not have been my first guess (or 2nd) on who Kanye would partner with to launch an apparel line.

Will be fascinating to see where this goes and whether Kanye can do for Gap what he did for Adidas. This actually kind of makes me want to take a small speculative investment in Gap…(This is not investment advice! I don’t think the Gap is a good investment…so I would not recommend this unless you have spare change you don’t mind losing.)

Regardless of what your views on Kanye are, you have to agree that he certainly thinks outside of the box in everything he does both creatively and non-creatively.

Capital Flywheels was very skeptical of the Adidas shoe partnership years ago. But I’ve been happily proven wrong. And his success (truly!) in going from 0 to 100 against Nike and creating one of the most valuable shoe lines in less than a decade is highly, highly impressive. Nike spends billions of dollars on marketing, harnessing the star power of hundreds of thousands of athletes in order to create and reinforce its brand aura. Kanye built a brand that could stand up to that based on his own star power alone.

Speaking of Nike…Bloomberg had a fantastic piece on sneakerheads and the sneaker market (made even more infamous because it profiles the son of a major Nike executive…whom was fired shortly after this piece was published). As Capital Flywheels mentioned in Tidbits #34, the sneaker market is something I’ve been highly fascinated with for years. And companies like StockX and GOAT are pretty high on my list of potential investments if / when they go public. This will either make sense to you or not…sneakers as a store of value is probably the OG cryptocurrency…

#8 Sneakerheads Have Turned Jordans and Yeezys Into a Bona Fide Asset Class

The sneaker boom has created opportunities for a new generation of speculator. Hebert and other young resellers are the first to treat footwear as a bona fide asset class, products as worthy of informed valuation and investment as any other commodity. The sneaker market, for them, is a lot like playing the market. In the hours after siphoning up stock from retailers, they essentially sell short-term futures based on street sentiment. By the time prices plateau, ultra-rare shoes such as the Air Jordan 1 OG Dior—a collaboration between Nike and the Parisian fashion house that was limited to 8,500 pairs—have become “grails” worth $10,000 or more, while more attainable stock has been bundled into tranches and sold on to other resellers at a bulk discount. Like their new fellow travelers, the day traders of Reddit, sneaker resellers have used community and technology to exploit a system that wasn’t quite ready for them. But unlike the GameStop crowd, they aren’t really making a point along the way; they’re just making a profit.

Capital Flywheels is constantly annoyed with the blasted use of technology to cop shoes…many of the most highly coveted shoes are “dropped” with limited supply. And Capital Flywheels can never beat out “professionals” like Hebert that have figured out how to game the system perfectly with bots. Though I’d like to wear these shoes instead of resell them, Capital Flywheels does not make enough money to want to pay 100-1000% premium on retail price.

And here’s probably the greatest sales pitch for StockX anyone could ever create:

Shoppers were avoiding stores and flocking instead to e-commerce platforms such as StockX, where young entrepreneurs like him were offering “deadstock.” The term, once used by retailers to describe unsold, discontinued items gathering dust on store shelves, has been adopted by resellers, who emphasize that the styles are no longer made and the items are still in their original packaging. Jesse Einhorn, senior economist at StockX, says that May and June were the platform’s two biggest months since its February 2016 launch. It likely got a bump, too, he notes, from ESPN and Netflix’s airing, starting in mid-April, of The Last Dance, a 10-part chronicle of Michael Jordan’s final season with the Chicago Bulls, which drew many older buyers into the market for the first time.

That was also a breakout time for West Coast Streetwear. “I remember the night the stimulus checks hit. My sales tripled,” Hebert said. “In May we did $600,000.” This would have vaulted him into the upper echelons of sneaker resellers at StockX, according to a company spokesperson, who says those are the numbers of “a top-tier power seller.” An opportunity was clearly presenting itself. The teenager had a problem, though: Supply chain issues were starting to translate into fewer shipments to wholesalers. The shoes he needed were still out there in stores, their prices slashed, but if he wanted to buy the dip, he’d have to get creative.

Hebert’s reselling career started in high school, when he noticed that some Supreme T-shirts he owned were going online for two or three times what he’d paid. The margin traced at least partly to the 2016 launch of StockX, where limited-edition releases from Supreme, Off-White, Palace, and other streetwear brands were finding new life. The resale site was giving Hebert’s generation its own EBay—a “stock market of things” where transactions were public and items could be valued accordingly. “If you throw out everything else, StockX is a price guide,” says co-founder Josh Luber. “It’s a price guide that moves in real time, looking at supply and demand to understand the value of any particular shoe.”

StockX is one of the most interesting and underrated companies that Capital Flywheels has ever seen. Because many people (unless you are a sneakerhead) will likely never have heard of it or come across it. But what StockX does goes beyond sneakers. What StockX is doing is trying to create a financial market for ANYthing. In a way this is Ebay 2.0 or Amazon, but StockX has a lock on everything with limited supply. And part of the value add is that StockX has people devoted to authenticating the products that are listed on the platform. This is a very hard edge to beat. Having studied many, many business models over the years, companies with “authority power” are some of the hardest to displace and easily command pricing power.

And this:

The potential to get rich quickly, in an informal setting with little oversight, drew a new breed of extremely online Gen Z trader. Most were White men, according to Adena Jones, chief executive officer and one of two Black co-founders of Another Lane, which launched its own digital marketplace for kicks last April. Jones and her husband, Chad, raised $160,000 to start their business by selling off shoes from their own collection. “Part of the reason,” she says, “was to have a voice in this culture that we started.” She’d seen sneaker reselling become highly transactional—“like buying wheat or oil,” in contrast with the approach of her husband, “who has been to the weddings of people he’s sold sneakers to.”

I was boots on the ground, camping out in front of shoe stores. Then all of the sudden this middleman emerged.”

The ultimate middleman was StockX, which came about in part as a stabilizing force. In 2014, when Luber was still an IBM consultant with a sneaker blog, he told the Financial Times that the secondary market for sneakers was “more similar to the illegal drug trade” than a stock exchange. Two years later he launched StockX with an eye to changing that. He’s succeeded well enough that Einhorn, the senior economist, created a hypothetical index fund of 500 sneakers that he found outperformed the S&P 500 by a few percentage points. “The index of the top 500 increased about 30% since 2018, and about 75% of the sneakers in that portfolio gained resale value,” he says.

Source: Bloomberg

You think Robinhood is interesting? I think StockX is more interesting. The Robinhood and GameStop saga was a sideshow to what Gen Z really wants. Things of limited supply. Things that they believe in (for a little while it may have been GameStop, but what Gen Z fundamentally believes in is Jordan, Yeezy, Supreme, etc). These things have innate value in the same way that boomers think stock fundamentals have value. As a business model and fundamental investor, Capital Flywheels thinks it’s odd to think of shoes as having fundamental value beyond protecting your feet, but status has value. Capital Flywheels has been thinking a lot about the changing nature of status and how status is gained in modern society. StockX is a reflection of that changing gateway to status.

💬 Media

#9 Google to Stop Selling Ads Based on Your Specific Web Browsing

Google plans to stop selling ads based on individuals’ browsing across multiple websites, a change that could hasten upheaval in the digital advertising industry.

The Alphabet Inc. company said Wednesday that it plans next year to stop using or investing in tracking technologies that uniquely identify web users as they move from site to site across the internet.

The decision, coming from the world’s biggest digital advertising company, could help push the industry away from the use of such individualized tracking, which has come under increasing criticism from privacy advocates and faces scrutiny from regulators.

…

About 40% of the money that flows from advertisers to publishers on the open internet—meaning digital advertising outside of closed systems such as Google Search, YouTube or Facebook—goes through Google’s ad buying tools, according to Jounce.

Source: WSJ

The end of an era is coming. Apple got this train going, but it’s not clear the train is going where they thought it would go. Apple’s decisions to destroy the cookie is only making Google more entrenched. Google is now moving away from tracking across the web. While this sounds great, it’s not a particular problem for Google (and other major internet properties) that have 1st party data. For Google services like Youtube and Gmail, you are likely always signed in. Google doesn’t have to play tracking games with you because you have already consented to that tracking on the specific service you are on. But the death of tracking across the web is going to be a problem for all the smaller websites that depend on Google for targeted advertising placement and revenues. Without sophisticated tracking, many of these smaller websites will have an issue placing relevant ads and generating revenues. A woman browsing a blog, for example, may never click on a poorly targeted ad trying to sell male pajamas.

This is good in some ways in the sense that privacy is good. But the path towards that land of privacy is entrenching us further and further in a few tech mega-ecosystems and the doors behind us are drawing shut.

Every change has pros and cons, and as a result, I feel rather neutral about this. Small businesses / websites will need to adjust. They will eventually adjust, but perhaps not the same players (small businesses that don’t adjust will just go away and new ones that can adjust will replace them). And from an investment perspective, all the more reason to invest in the tech mega-ecosystems that command 1st party data like Google, Facebook, Snapchat, Pinterest, etc.

BUT…the industry won’t just take it lying down. And The Trade Desk (TTD) may be riding to the rescue. TTD has risen very quickly and has captured a very significant share of the advertising market…it was a mistake for Capital Flywheels to not devote more attention to them when Capital Flywheels first heard about them in 2017.

#10 Google Crushed Many Digital Ad Rivals. But a Challenger Is Rising.

Alphabet Inc.’s Google has crushed almost all its competitors in the world of digital-advertising technology. But one rival is emerging as the best hope to challenge the tech giant—if it manages to keep up its momentum.

The Trade Desk Inc., which specializes in helping companies buy online ads across publishers’ websites, did what others failed at: eating into Google’s share of the market. While Google dominates that area of ad-buying with about 40% of the business, Trade Desk is up to nearly 8% and its share is growing faster than Google’s, according to ad-tech consulting firm Jounce Media.

…

Google’s announcement Wednesday that it will end targeting of ads based on individual users’ web-browsing behavior, and focus on targeting based on larger groups or “cohorts,” could pose risks for Trade Desk. Billed as a privacy move, the change could actually play to Google’s strengths, Mr. Green and others in the industry say, because it has so much other data on consumers to use for targeting ads.

“They are leaning on an advantage that they have from very big near-monopoly businesses so that they can provide targeted advertising while they’re taking steps to inhibit others’ ability to provide targeted advertising,” Mr. Green said in an interview.

…

To offset the loss of cookies, Trade Desk is recruiting publishers and ad-tech companies to create a new identifier for users, Unified ID, which would be compiled from your email address but scrambled to protect your privacy. Any company in the network would be able to access a user’s Unified ID profile and contribute data to it. Unified ID already has profiles for 50 million people, a Trade Desk spokesman said.

Source: WSJ

But is this just a bandaid? TTD is trying to create a new universal ID (UID 2.0) to replace the tracking functions of the cookies. It still tracks you…but in a more privacy-respecting way. The actual implementation is probably too arcane to discuss here, but it’s an interesting workaround that shares just enough (your hashed email, hidden behind a unique identifier that CANNOT be tied back to you) to allow advertisers to target relevant ads to you without really knowing anything about you.

#11 Microsoft Steps Up Push to Bring Virtual Reality to the Masses

Microsoft Corp. unveiled software tools designed to make it easier and less expensive for people to access virtual reality and augmented reality content, and for more creators to build these digital and holographic worlds.

The company’s Mesh software will enable users to work and play together virtually by interacting with the same set of holograms on devices at various price points and from different manufacturers, ranging from Microsoft’s $3,500 HoloLens augmented reality goggles and Facebook Inc.’s Oculus and other specialized VR headsets to cell phones and computers where users can get a two-dimensional view. Mesh also lets multiple people see the same holograms from different locations, allowing for events such as concerts or company meetings where one user attends in person and the other “holoports in” from home.

…

“There’s always the cost, but there’s also — what’s that ubiquitous device that I have with me always that I can use to interact? It’s not like I have a HoloLens on me — it’s not like I am wearing it right now,” Nadella said. “Whereas, I have a computer right now or I’m using my phone. That’s why Mesh is not just about HoloLens.” Seeing 3-D holograms will still require some sort of headgear, Nadella said, but as more AR and VR experiences become available for larger groups, phones and PCs allow a way in without expensive devices.

Source: Bloomberg

Whereas players like Facebook and Apple are focused on building up a compelling device / ecosystem in order to accelerate adoption of VR / AR, Microsoft is broadening efforts to enable VR / AR experiences across more devices in order to lower the barriers to adoption.

This bears watching not only because VR / AR is potentially one of the most transformative trends in the next 10 years and Microsoft certainly has a lot of resources, but because it also puts them a little closer in competition with Unity. Unity is currently the leader in powering VR / AR apps.

Also check out this intro video of Microsoft Mesh:

#12 Netflix has created a TikTok clone that lets people scroll through funny clips

Netflix is launching a new mobile feature that gives subscribers the opportunity to get their fill of laughs in for the night without having to watch a whole TV show or movie.

Fast Laughs, currently only available for iOS device owners in select countries, looks and feels like TikTok or Instagram Reels. Different short clips — taken from shows like Big Mouth or stand-up specials from comedians like Jerry Seinfeld and Ali Wong — play directly within the Netflix app. If one of the shows, films, or specials sparks interest, people can add said title to their saved list to watch later.

Source: The Verge

I kind of like this!

Netflix’s sister company, Roku (which was spun out of Netflix years ago), also seems to be doing some interesting things:

#13 Roku’s advertising ambitions just got even bigger with new Nielsen deal

Roku, one of the most popular streaming platforms in US homes, is acquiring Nielsen’s video advertisement business as it tries to become a central hub for TV advertising.

Specifically, Roku is acquiring Nielsen’s Advanced Video Advertising unit. The acquisition means that Roku will also acquire Nielsen’s automatic content recognition (ACR) and dynamic ad insertion (DAI) technology. DAI technology simply means that advertisers will be able to receive “better targeting and measurement” capabilities so they can hyper-target a specific audience instead of more broad demographics like age and gender. Think of ads for products people might actually want playing before a YouTube video compared to seemingly random ads playing on CNN.

…

When NBCUniversal executives were trying to negotiate with Roku over bringing their new streaming service, Peacock, to Roku devices, a large part of the delay came from disagreements over advertising inventory. NBCUniversal executives didn’t want to give up a significant portion of their advertising revenue (Roku typically takes 30 percent of ad inventory, but works out specific deals with each partner depending on the offering). Peacock is also ad-supported, and NBCUniversal developed its own targeted digital advertising technology to try and persuade advertisers to place commercials on the platform. Giving up a percentage of that advertising revenue is a tough pill to swallow.

Source: The Verge

Roku is quite fascinating. Capital Flywheels had a personal investment in Netflix starting in 2011 around the Qwikster fiasco (though no more…unfortunately, sold too soon). Funny to think that Netflix stock got cut in half because Netflix wanted to spin out the DVD business. This wasn’t 2001. This was 2011. Funny how obvious it is in hindsight how wrong the average investor was about what was going to be relevant…and how soon (or late).

Anyway, I’ve overlooked Roku over the years because I assumed streaming is the future and the traditional media value chain was going to be disrupted sooner or later. And Roku looked too much like a bandaid for the traditional media value chain. Interestingly, Roku has evolved their own model of success.

Not only has Roku successfully aggregated one of the largest audiences, it is now also gaining leverage by gobbling up advertising infrastructure. And this is even before taking into account their own semi-efforts at creating their own content (for distribution on the Roku Channel).

I’ve overlooked this story, but there’s a lot of fascinating things going under the hood.

💰 Fintech

#14 Goldman Consumer Head Is Leaving to Run Walmart Fintech

A Goldman Sachs Group Inc. GS -0.58% executive who helped build its consumer-banking business from scratch is leaving to take on a similar task at Walmart Inc. WMT 1.25%

Omer Ismail, a Goldman partner and the head of its Marcus consumer unit, is leaving the bank to run a recently announced Walmart financial-technology startup, according to people familiar with the matter.

…

Walmart said in January that it was creating a majority-owned fintech subsidiary in a partnership with venture-capital firm Ribbit Capital,LEAP -6.00% a backer of Credit Karma Inc., Affirm Holdings Inc.AFRM -3.93% and other fast-growing startups.

“Our customers have been clear that they want more from us in terms of financial services,” Walmart Chief Executive Doug McMillon said at an investor event earlier this month. “This new approach will help us deliver for them in a differentiated way more quickly.”

Joining Mr. Ismail at Walmart will be David Stark, some of the people said. A former Citigroup Inc. executive who joined Goldman in 2015, Mr. Stark helped it land and build credit-card offerings with Apple Inc.and General Motors Co.

Source: WSJ

The banking industry is struggling, but Goldman isn’t exactly a sinking boat. Goldman also pays pretty well (especially at the partner level+). Walmart must have a pretty compelling vision to bring some high profile hires away from Goldman.

#15 Square Financial Services Begins Banking Operations

Today, Square, Inc. announced its industrial bank, Square Financial Services, has begun operations after completing the charter approval process with the Federal Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions.

Square Financial Services is an independently governed subsidiary of Square, Inc. Headquartered in Salt Lake City, Utah, its primary purpose will be to offer business loan and deposit products, beginning with underwriting and originating business loans for Square Capital’s existing lending product. Moving forward, Square Financial Services will be the primary provider of financing for Square sellers across the U.S.

“Bringing banking capability in-house enables us to operate more nimbly, which will serve Square and our customers as we continue the work to create financial tools that serve the underserved,” said Amrita Ahuja, Square, Inc. Chief Financial Officer and Executive Chairwoman of the board of directors for Square Financial Services. “We thank the FDIC and Utah DFI for their partnership enabling us to reach this milestone, and look forward to continuing to expand access to financial services at this critical time for small businesses.”

Source: Square

Square’s establishment of an industrial bank was announced a while ago, but it is now finally up and running.

🛍 Commerce

#16 Square Report: The Future of Retail 2021

Square published a report highlighting recent research based on a survey of 500 small business owners and 1000 consumers. The report is focused on the changing nature of retail, and how small businesses can (and do) adapt. Not only do small businesses have some advantages over large retailers as well as platforms like Amazon, consumers also want to support small businesses. This is good for Square and Shopify.

Retailers have been driven to go where customers have gone, focusing on selling across a variety of channels, known as omnichannel retailing. Big-box retailers used to dominate the omnichannel space. But as consumers prioritize connection, convenience, and products they can’t find anywhere else, local retailers are redefining what a successful omnichannel experience can look like for independent businesses. By investing in new technology and channels to highlight what they’re already so good at, independent retailers are winning the hearts of local customers — and beating larger players.

“Local retailers have advantages over big players, like Amazon and Walmart, in that they’re physically close to their customers, and they offer a more curated and higher-quality selection of products,” says David Rusenko, Head of eCommerce at Square. “That creates opportunities to shine.”

Many small retailers are also discovering that social commerce gives them an advantage over large retailers:

Social-first selling is giving local retailers the tools to drive more purchases, along with the flexibility to reach larger audiences beyond their geographic area. With so much competition for consumer attention, retailers are taking a creative approach. “We’re seeing retailers take a QVC-style approach on TikTok or doing flash sales on Instagram where customers have to direct message the brand at a certain time to get the product,” Rusenko says. “It creates a sense of urgency.”

…

Social selling gives local retailers a leg up on big-box competition, allowing them to reach a hyper-local group of customers while building community. A social account from a local mom-and-pop retailer that posts about (and sells) what their community cares about builds more trust with these customers than a large retailer. Instagram, Pinterest, and Facebook provide commerce features that allow retailers to target this hyper-local audience, making it easier to send customers to their digital storefronts and keep them engaged.

…

Retailers selling on social media channels say they see an average of 40% of their online revenue from direct sales on social media. Their results are fueling a broader interest in social selling: 84% of retailers who sell online either already sell on social media channels or plan to start in the next 12 months.

This is also interesting:

The opportunity to shop in virtual reality is even more exciting to Millennial and Gen Z consumers (39% of whom are interested in VR shopping). The draw? It’s a reimagined online shopping experience that’s immersive and creates the same excitement and sense of discovery customers enjoy when shopping in a physical store. A third of retailers surveyed say they’re likely to implement VR shopping in 2021, enabling consumers to experience their retail space from anywhere.

Source: Square

China has already been leading the way in live-streaming commerce. The rest of the world is increasingly moving in that direction as well.

The VR comments are fascinating because it’s really hard to pinpoint where mainstream interest in VR (or AR) is. 5 years ago, I would say there was mainstream fascination but skepticism around VR / AR. Now I think the mainstream population wants it and is waiting patiently for the tech to mature. I continue to believe AR will be the most transformative tech in the coming 10 years. And the success and failures here will re-draw the tech landscape in dramatic ways, especially in social media / networking and commerce.

#17 Twitter Tests New E-Commerce Feature for Tweets

Twitter confirmed it’s testing a new way to display tweets that link out to e-commerce product pages — like products on a Shopify store, for example. With a new Twitter card format, the company is experimenting with tweets that include a big “Shop” button and integrate product details directly into the tweet itself, including the product name, shop name and product pricing.

…

While these tweets would work well as ads, Twitter confirmed to us the tweet is an example of a new treatment for “organic” tweets focused on e-commerce.

Source: TechCrunch

Source: Twitter

Even Twitter is getting into the social commerce game. Twitter is really upping their game across the board.

#18 Pinterest Hosts its First Ad Summit and Opens New Video Ad Space to Brands

On Wednesday, Pinterest announced the new ad product it named Pinterest Premiere, which will appear in people’s feeds, targeted to their interests and other characteristics. Pinterest Premiere was just one of the points of focus at Pinterest Presents, which was the first advertising summit from the company. Pinterest Presents was held virtually and featured celebrity guests Chrissy Teigen and Dan Levy, as well as brands like American Express.

Pinterest showed off the new video ads, its consumer prediction powers, shopping tools, and other flairs of the platform in the presentation, which was similar to what a lot tech peers have been hosting lately in showcasing digital ad products to brands and ad agencies. Snapchat, TikTok and Twitter have all held similar events, so far, this year.

Liz Cole, executive director and U.S. head of social at VMLY&R, attended the event and said that the video product had potential for retail, food, apparel and home improvement brands, in particular. It’s an ad unit that is similar to ones that Twitter, Snapchat and TikTok offer, giving brands a prominent “takeover” position. Pinterest is in a unique position, Cole says, because it also has a line into people who are looking to hear most from brands at moments they are considering purchases.

Source: Ad Age

Capital Flywheels is very excited about the roadmap at Pinterest. The product is not for everyone, but for the people that use it, it is highly differentiated. And because of its differentiated use case (often involving high intent, long-term planning), it’s becoming a highly differentiated channel for advertisers and merchants.

The value of advertising is in changing someone’s mind. The goal of advertising is to get someone to buy something instead of the alternative (which could be no purchase at all or a purchase of an alternate brand). The goal of advertising is not to make you buy what you would have already bought anyway. That’s why Pinterest is so valuable to advertisers. You have a window into a consumer that has an intent to purchase, the window is long, and you have insights into what products and brands are being considered organically. This means more opportunities for an advertiser to change the consumer’s mind about what to purchase.

As a point of comparison, search advertising fundamentally provides you no window into what alternatives are being considered until someone clicks a competing brand’s link. But by that time, the consumer is already off Google…and there is no way to change the person’s mind anymore. Google tries to solve this with very targeted data collection to infer this over time so that your ads go in front of people you want to target. But Pinterest literally knows all the alternatives you are considering because you (as a user) have actively taken the time to pin them to your own board.

Meanwhile, here is Capital Flywheels’ periodic reminder that the player with the largest opportunity in commerce remains Facebook / Instagram / WhatsApp.

The risk is Mark Zuckerberg remains too wrapped up in politics to be able to capture this opportunity before others do it.

The article below from Protocol is well worth reading to better understand the history of the efforts at WhatsApp to drive commerce as well as the challenges they face:

#19 WhatsApp thinks business chat is the future — but it won’t be easy

WhatsApp’s best answer is business chat. In recent years the app has become a place where millions of businesses can set up shop, and billions of potential customers can browse and buy. Bakeries are taking orders through WhatsApp; airlines are doing customer support; doctors are taking on and seeing patients; people are registering for COVID-19 vaccines. “When you get outside of the U.S. and into some of the countries where WhatsApp is really popular,” Will Cathcart, Facebook’s head of WhatsApp, told me, “whether or not we build any [specific] tools people use it to communicate with businesses.” All WhatsApp realized was that it could make things better, and maybe help everyone — including WhatsApp — make more money.

…

So far, it’s working. The WhatsApp Business app has more than 50 million users, and thousands of large companies are set up on the API. Around 175 million people message a business every day on WhatsApp. There are 8 million business catalogs available for viewing on WhatsApp. Right now, WhatsApp charges for some of the features in the API, but could also start adding payment-processing fees and more paid features over time. The flywheel is whirring, and WhatsApp continues to invest in business tools.

Source: Protocol

👨💻 Technology

#20 Okta Signs Definitive Agreement to Acquire Auth0 to Provide Customer Identity for the Internet

Okta, Inc. (NASDAQ:OKTA), the leading independent identity provider, today announced it has entered into a definitive agreement to acquire Auth0, a leading identity platform for application teams, in a stock transaction valued at approximately $6.5 billion. Together, Okta and Auth0 address a broad set of identity use cases and the acquisition will accelerate the companies’ shared vision of enabling everyone to safely use any technology, shaping the future of identity on the internet.

…

“Combining Auth0’s developer-centric identity solution with the Okta Identity Cloud will drive tremendous value for both current and future customers,” said Todd McKinnon, Chief Executive Officer and co-founder, Okta. “In an increasingly digital world, identity is the unifying means by which we use technology — both at work and in our personal lives. With so much at stake for businesses today, it’s critical that we deliver trusted customer-facing identity solutions. Okta’s and Auth0’s shared vision for the identity market, rooted in customer success, will accelerate our innovation, opening up new ways for our customers to leverage identity to meet their business needs. We are thrilled to join forces with the Auth0 team, as they are ideal allies in building identity for the internet and establishing identity as a primary cloud.”

Source: Businesswire

The market didn’t seem to like the high price tag. But the deal is done entirely in stock. And Okta’s stock is valued pretty highly at the moment, so this deal seems like a long-term win to me.

Is the deal rich? Yes. Is Okta stock expensive relative to current / near-term fundamentals? Absolutely.

But Okta has the potential to become the neutral, independent identity layer for the whole internet. The greatest risk isn’t that they can’t figure out how to make enough money eventually…the greatest risk is that they fail at successfully becoming the identity layer for the internet. Anything they do to ensure they can do that is worth far more than people will give them credit for near-term. And that’s okay (as long as they don’t take immense balance sheet risk through debt). Because controlling identity is one of the most valuable powers any company (or government) can ever have. If that’s not worth $30 billion, then I’m not sure what is.